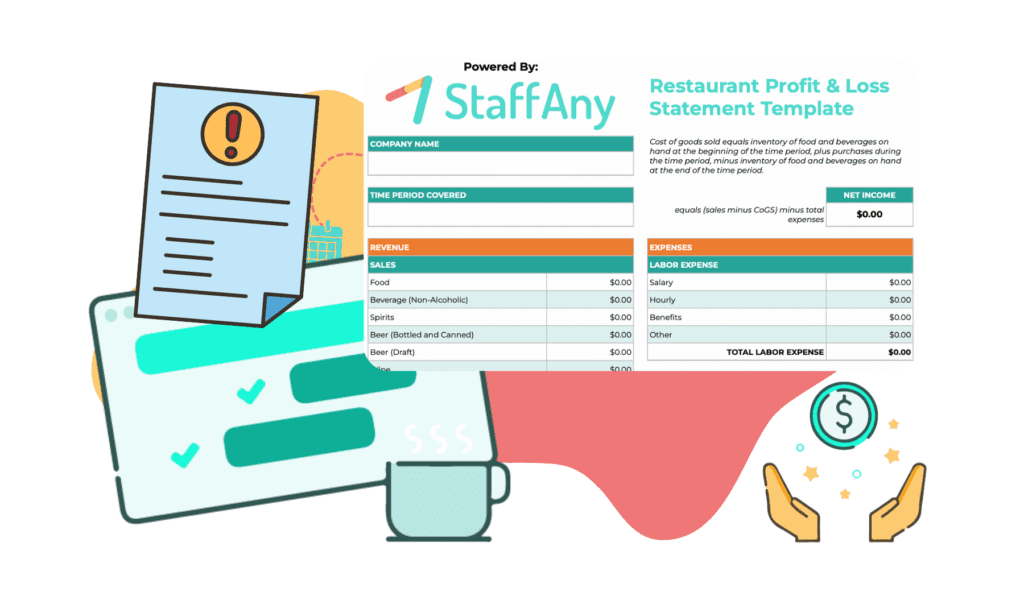

Free Template for Restaurant Profit & Loss Statement by StaffAny

When it comes to tracking profits, the restaurant business is a tricky one to calculate. Restaurant owners need to keep track of tons of different revenues and costs, from food cost percentages to payroll, rent, and more. Download our profit and loss statement template to make sure you have the information you need.

How Can Our Template Help You?

- Analyze your financial status.

- Make better financial decisions.

- Simplify the calculation process.

Do you find it useful? Share it with others and let them know how you make your employee availability sheet.

Did you know?

StaffAny has helped companies across multiple countries in several other ways.

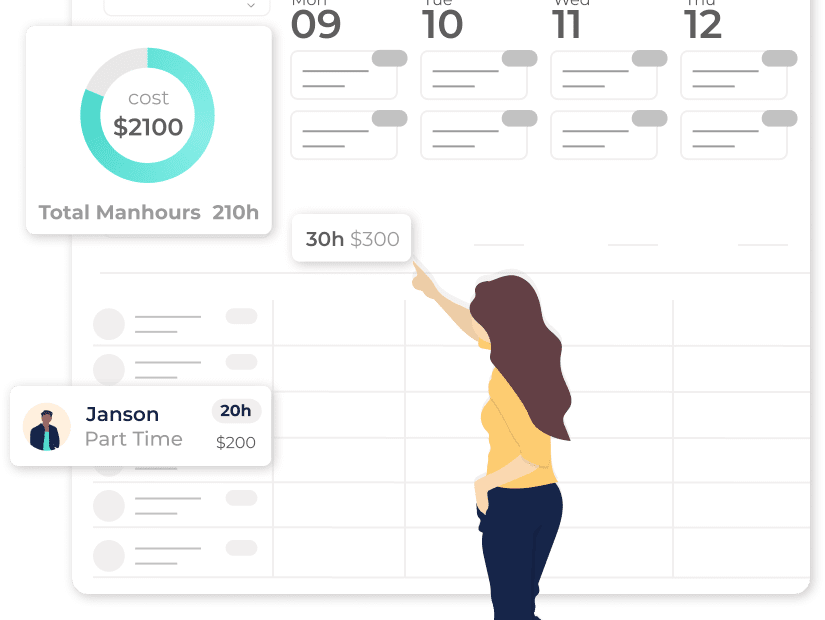

Cost Optimization

Up to $24K annual labor cost savings

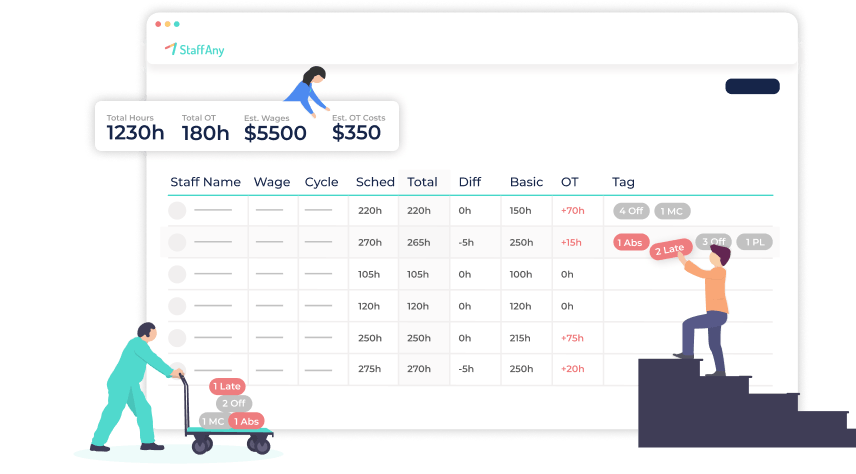

Time Savings

50% faster timesheet consolidation

Punctuality

For Owner/ HRs Who Want Better Cost Control

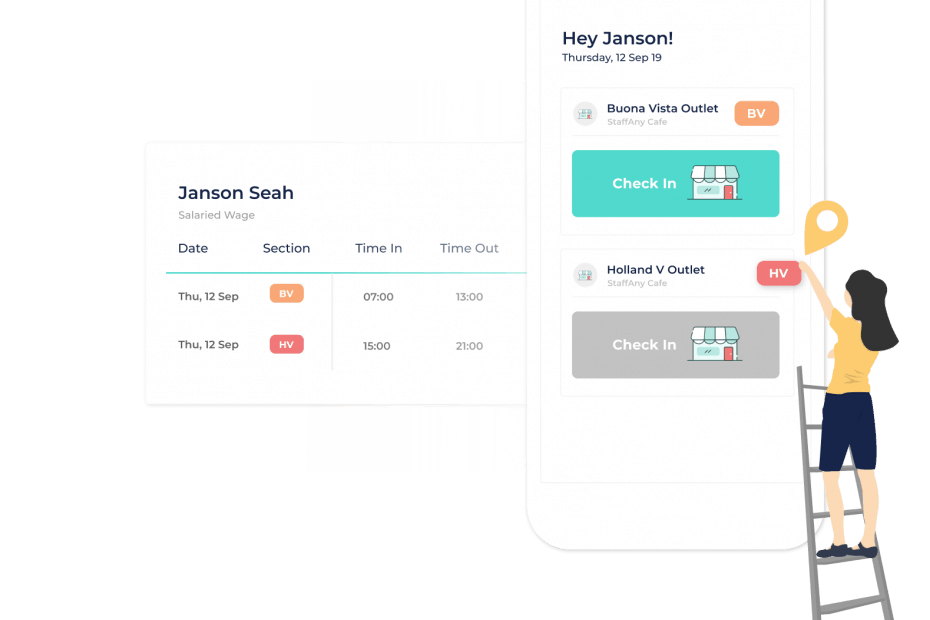

Time Tracking Made Easy

Modern Time and Attendance software with features that empowers you with real-time visibility and decision-making abilities, resulting in efficiency, cost savings and faster timesheet consolidation, as much as 50% faster.

More Punctuality, Increasing Efficiency and Better Control

StaffAny Restaurant Profit and Loss Statement

The restaurant profit and loss statement is a comprehensive financial tool that provides a detailed overview of a restaurant’s financial performance over a specific period. This statement presents a breakdown of the business’s revenues, costs, and expenses, offering valuable insights into the overall profitability and operational efficiency of the restaurant.

By examining the restaurant’s profit and loss statement, business owners and managers can gain a comprehensive understanding of the key factors impacting the business’s financial health. This includes evaluating revenue streams from the restaurant income statement, such as food and beverage sales, assessing the impact of operating expenses such as raw materials, labour, waste removal, and overhead expenses, and identifying any potential areas for cost-saving or revenue growth to increase the restaurant’s financial health.

Moreover, the profit and loss statement enables businesses to assess their financial viability and make informed decisions regarding pricing strategies, menu planning, and cost management. By analysing the data presented in the statement, businesses can identify trends, patterns, and potential areas for improvement, allowing for the implementation of effective strategies to enhance profitability and operational efficiency.

Additionally, the restaurant’s profit and loss statement facilitates effective financial planning and budgeting for restaurant operators. By providing a clear picture of the restaurant’s financial performance, this statement helps businesses set realistic financial goals, allocate resources efficiently, and make informed decisions contributing to create profitable business.

In essence, the restaurant profit and loss statement is a vital tool for businesses to assess their financial performance and make strategic decisions that drive profitability and operational success. By leveraging the insights provided by this statement, restaurants can implement effective financial management practices, improve cost control measures, and ensure long-term financial stability and success.

Frequently Asked Questions

A Profit and Loss (P&L) is a financial report that summarizes a company’s income, expenses, and expenditures over a specified period of time.

The profit and loss statement of any company reflects financial profitability. This is a binding declaration, which is important for all companies and should be drawn up with due care. Failure to do so can seriously jeopardize the survival of both small and large businesses.

Ideally, a profit and loss statement should be produced daily. Daily performance analysis allows you to quickly respond to overspending and adjust business operations to avoid very costly mistakes.

There are two types of profit and loss accounting, the cash accounting method and the accrual method. Cash Payment Methods – Cash payment methods only take into account cash amounts received or paid. This method is often used by small and medium businesses. Accrual basis – On the other hand, accrual basis considers income even if the money has not yet been received. Liabilities that have not yet been expensed are also recorded.

It shows the company’s net profit or loss during the period. This report helps companies track their financial performance and make informed operational decisions.

A Profit and Loss statement is a compilation of important information that should be considered by the company’s owners (or shareholders), management, investors, suppliers and customers, and potential investors.