In the bustling economic landscape of Singapore, it’s crucial for businesses to have a firm grasp on their financial operations. One fundamental aspect of financial management is understanding how to calculate prices before the inclusion of Goods and Services Tax (GST).

In this article, we will delve into the intricate world of GST, exploring its purpose, registration requirements and procedures, and most importantly, how to calculate prices before GST in Singapore. By the end, you’ll have a comprehensive understanding of this essential aspect of running a business in Singapore. Let’s get started!

What is Goods & Services Tax (GST) for in Singapore?

Goods and Services Tax (GST) in Singapore serves a crucial role in the country’s taxation system. This value-added tax, often referred to as VAT in other countries, is imposed on a wide range of goods and services. Its primary purpose is to generate revenue for the government, which is essential for funding public services and infrastructure development.

Singapore’s GST is set at a rate of 8%, making it a significant contributor to the country’s revenue stream. It’s important to note that while GST is applied to most goods and services, there are exemptions in place to ensure fairness and affordability, such as exemptions for the sales and leases of residential properties, investment precious metals, and various financial services.

Understanding the role of GST in Singapore is essential for businesses and consumers alike, as it directly affects the prices of goods and services in the country. Whether you’re a business owner or an everyday consumer, having a clear grasp of GST is vital for making informed financial decisions and ensuring compliance with tax regulations.

GST Registration Requirements in Singapore

Understanding the Goods and Services Tax (GST) registration requirements in Singapore is pivotal for businesses operating in the country. The following guidelines outline when and how companies should register for GST, whether it’s mandatory or voluntary.

Mandatory Registration Threshold

Companies in Singapore must register for GST when one of the following conditions is met:

- Exceeding the Threshold: If a company’s taxable turnover (GST-applicable revenue) for the past 12 months exceeds SGD 1 million, it is legally obliged to register for GST.

- Expected Exceedance: If a company anticipates that its taxable turnover will exceed SGD 1 million in the next 12 months, it must also register for GST.

Companies are responsible for monitoring their taxable turnover at the end of each quarter to determine if they meet the registration threshold.

Companies that have surpassed SGD 1 million in taxable turnover over the previous 12 months must initiate GST registration within 30 days from the end of the last quarter when this occurred. For companies expecting to exceed SGD 1 million in taxable turnover in the next 12 months, GST registration must be initiated within 30 days of making that determination.

Voluntary Registration

Companies with annual taxable turnover below SGD 1 million are not obligated to register for GST. However, they retain the option to register voluntarily if it aligns with their business strategy. As part of the voluntary GST registration process, the company’s director(s) is required to complete two e-Learning courses, namely “Registering for GST” and “Overview of GST.” This requirement can be waived under certain conditions:

- If the company director has experience managing other existing GST-registered businesses.

- If the person responsible for preparing the company’s GST returns is an Accredited Tax Adviser (ATA) or Accredited Tax Practitioner (ATP).

- If the person preparing the GST returns has completed the specified e-Learning courses within the last two years.

It’s important to note that the Inland Revenue Authority of Singapore (IRAS) may impose additional conditions for GST registration and compliance. Failure to meet these conditions could result in the cancellation of the company’s GST registration.

Exemption From Registration

Some companies that would typically be subject to mandatory GST registration can apply for an exemption from IRAS if they meet the following criteria:

- Zero-Rated Supplies: At least 90% of the company’s total revenue must come from supplies that are not subject to GST, often referred to as “Zero-rated” supplies.

- Negative GST Balance: The net balance of GST collected for supplies versus GST paid for purchases must be negative. In other words, the company would have received a GST refund from IRAS as a GST-registered business.

It’s important to note that exempt companies, similar to non-registered GST companies, cannot claim the GST incurred on business purchases. Therefore, if a business expects to receive a credit for the GST it has paid, it must register for GST.

Read more: SOP for Food and Beverage Service

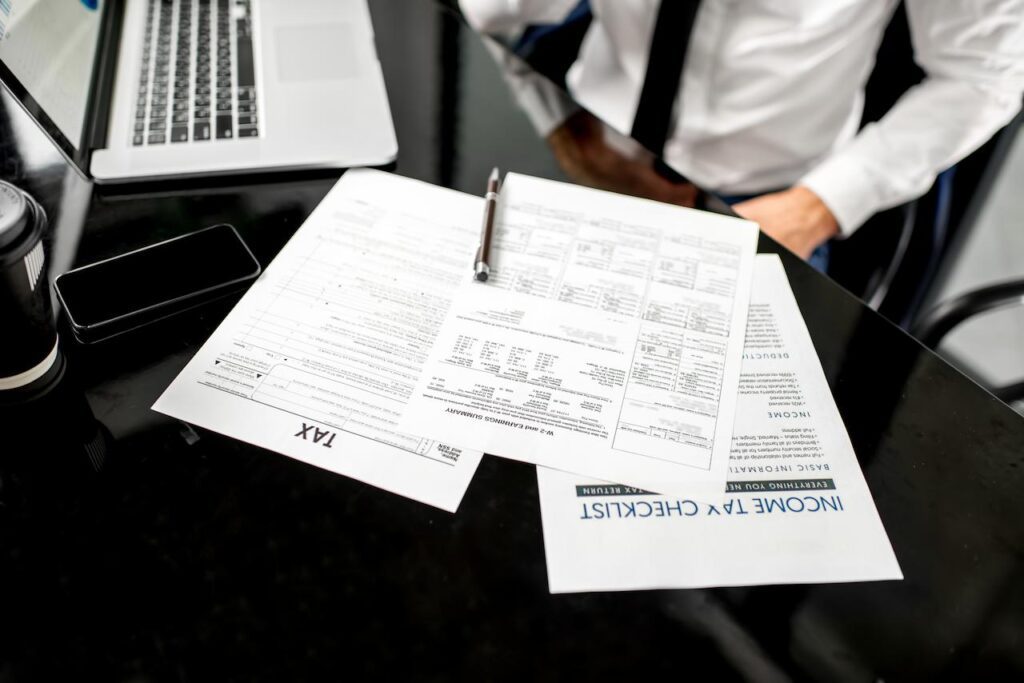

How to Calculate Price Before GST in Singapore

Calculating the price of goods or services before the inclusion of Goods and Services Tax (GST) in Singapore is a fundamental skill for businesses and consumers alike. This calculation ensures transparency in pricing and aids in financial planning. Here’s a step-by-step guide on how to calculate the price before GST:

Step 1: Start with the Selling Price

Begin by identifying the selling price of the goods or services. This is the price at which you intend to sell the item to your customers.

Step 2: Determine the GST Rate

In Singapore, the standard GST rate is 8%. However, there may be different GST rates for specific goods and services, such as zero-rated or exempt supplies. Ensure you know the applicable GST rate for the item in question.

Step 3: Use the Formula

To calculate the price before GST, use the following formula:

Pre-GST Price = Selling Price / (1 + (GST Rate / 100))

For example, let’s say you plan to sell a product for SGD 107, and the applicable GST rate is 8%. The calculation would be as follows:

- Pre-GST Price = 107 / (1 + (8 / 100))

- Pre-GST Price = 107 / (1 + 0.08)

- Pre-GST Price = 107 / 1.08

- Pre-GST Price ≈ SGD 99.07

So, the price before GST for this product is approximately SGD 99.07.

Step 4: Round to the Nearest Cent

In Singapore, prices are typically rounded to the nearest cent. Ensure that your pre-GST price is rounded accordingly to maintain consistency with local pricing practices.

Step 5: Display Clearly

It’s a legal requirement in Singapore to display prices before GST clearly in your invoices, price tags, and marketing materials. This transparency ensures that consumers know what portion of the price constitutes the tax, fostering trust and compliance with tax regulations.

Read more: 10 Common Problems in Restaurant Management

In conclusion, understanding how to calculate prices before Goods and Services Tax (GST) in Singapore is essential for transparent and compliant business operations. By following the simple steps outlined above, you can ensure that your pricing is accurate and that your customers know the pre-GST cost of your goods or services.

To further streamline your business operations and enhance efficiency in managing your workforce, consider integrating roster management software like StaffAny. This powerful tool can help you optimally manage your staff, schedules, and tasks, ensuring that your business remains competitive and compliant with both pricing and labour regulations in the dynamic Singaporean market.

With the right knowledge and tools at your disposal, you can navigate the complexities of GST and workforce management with confidence, ultimately contributing to your business’s success in Singapore’s thriving economic landscape. For more information, contact us here!